Investing in mutual funds has become increasingly popular due to its ease and accessibility. But have you ever wondered about the behind-the-scenes process of a mutual fund transaction? In this blog, we’ll break down the journey of a mutual fund transaction from start to finish, highlighting the key stakeholders involved and their roles.

Key Players in the Mutual Fund Transaction Process

- Mutual Fund Distributor (MFD)

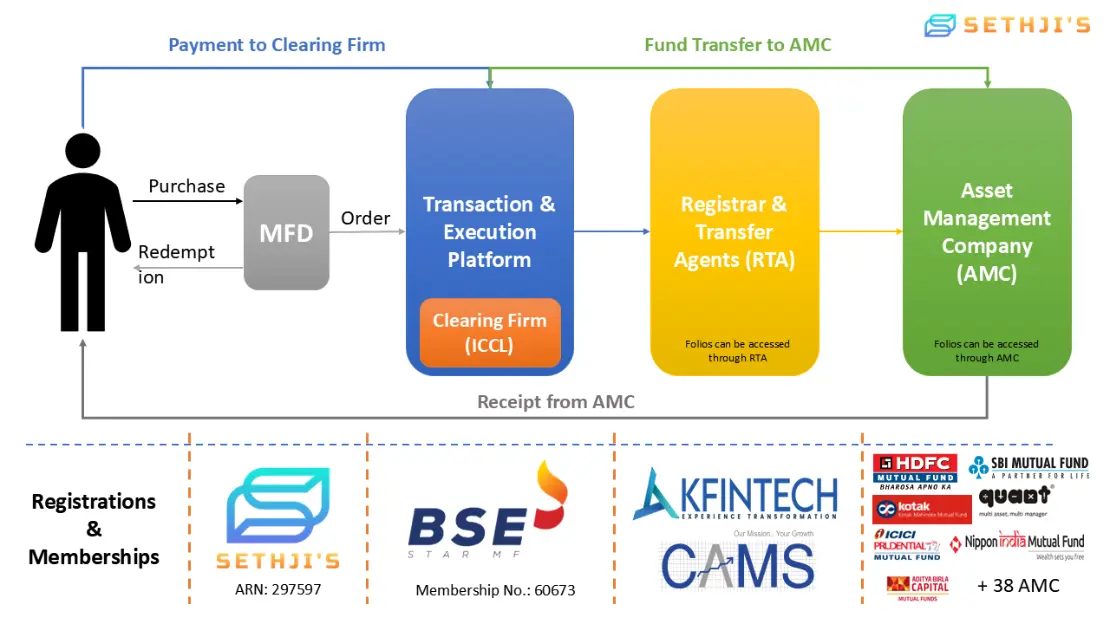

Mutual fund distributors act as intermediaries, bridging the gap between investors and mutual fund entities. They initiate transactions, whether it's a purchase or redemption, on behalf of the investor. - Transaction & Execution Platform

Think of this platform as the control center. It ensures that investor orders are routed efficiently to all the right entities involved in the transaction. - Registrar & Transfer Agents (RTA)

RTAs handle the critical task of record-keeping for mutual fund schemes. They process investor details, handle transactions, and maintain accurate records of purchases and redemptions. Investors can also access their folio details directly through the RTA. - Asset Management Company (AMC)

AMCs are the powerhouses that manage mutual fund schemes. When an investor buys mutual fund units, the AMC receives the payment. Similarly, during redemptions, the AMC disburses the proceeds. Folio details are also accessible through the AMC. - Clearing Firm

The clearing firm acts as the settlement body, ensuring smooth fund transfers between the investor, AMC, and other entities. It ensures payments are received and proceeds are distributed accurately.

How a Mutual Fund Transaction Works

For Purchases

- Investor Order Placement: The process begins when the investor places an order through the MFD.

- Payment Processing: The investor's funds are sent to the clearing firm, which verifies and processes the payment.

- Transfer to AMC: The clearing firm forwards the payment to the AMC, which then allocates mutual fund units to the investor.

For Redemptions

- Redemption Request: The investor initiates a request to redeem their mutual fund units via the MFD.

- Proceeds from AMC: The AMC calculates and releases the redemption amount to the clearing firm.

- Final Settlement: The clearing firm ensures the redemption proceeds are transferred to the investor's account.

The Importance of Compliance

All entities involved, including the MFD, are required to have appropriate registrations and memberships. For instance, mutual fund distributors must hold an AMFI Registration Number (ARN), and clearing firms need specific memberships to facilitate smooth transactions.

Conclusion

The seamless process of mutual fund transactions involves multiple players working in sync to ensure efficiency and accuracy. From the MFD to the AMC and the clearing firm, every step is meticulously structured to provide a hassle-free investment experience for you.

Understanding this flow not only deepens your knowledge as an investor but also enhances your confidence in the mutual fund system.

Have questions about mutual fund investments? Let us know in the comments or connect with a mutual fund distributor to start your investment journey today!